The market operations evidence summary for identifiers 241190, 55490000, 120755564, 1128214900, 641758842, and 635259531 underscores their role in optimizing operational efficiency and ensuring regulatory adherence. These identifiers facilitate systematic classification and tracking of financial instruments, which is essential for accurate data reporting. An analysis of performance metrics reveals insights into market effectiveness, prompting a closer examination of current trends and potential growth avenues. What implications do these factors hold for future market strategies?

Overview of Market Identifiers

Market identifiers play a crucial role in the efficient functioning of financial markets by providing standardized codes that facilitate the classification and tracking of various financial instruments.

These identifiers adhere to industry standards, ensuring consistency and accuracy in data reporting.

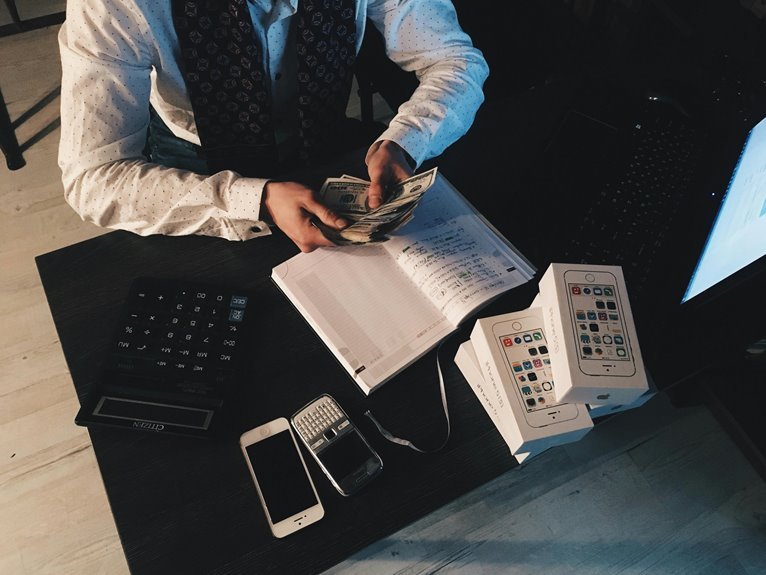

Performance Metrics Analysis

Performance metrics serve as vital indicators for assessing the effectiveness and efficiency of market operations.

Through rigorous metric evaluation, organizations can identify performance benchmarks that highlight areas for improvement.

Analyzing these metrics allows stakeholders to make informed decisions, ultimately enhancing operational freedom.

Current Trends in Market Operations

As organizations navigate the evolving landscape of market operations, several key trends are emerging that significantly impact strategic planning and execution.

Enhanced understanding of market dynamics drives companies to prioritize operational efficiencies. Data analytics and automation are increasingly utilized, enabling businesses to optimize resource allocation and adapt swiftly to changes.

This focus on adaptability ensures resilience and competitiveness in an ever-changing market environment.

Growth Opportunities and Strategic Recommendations

How can organizations effectively capitalize on emerging growth opportunities in today’s market landscape?

By identifying sectors with high growth potential, companies can prioritize strategic investments that align with market demands.

Leveraging data analytics to assess consumer trends will enhance decision-making processes.

Additionally, fostering innovation and adaptability will empower organizations to navigate uncertainties, ensuring they remain competitive and responsive to evolving market dynamics.

Conclusion

In a landscape where efficiency reigns supreme, the reliance on standardized identifiers like 241190 and 55490000 may seem trivial. Yet, as the market shifts and evolves, these seemingly mundane codes prove to be the unsung heroes of operational success. Ironically, those who underestimate their value may find themselves adrift in a sea of data chaos, while savvy stakeholders leverage these identifiers to navigate the complexities of modern finance with remarkable precision and foresight.